Kids, you don't know what you don't know, until you know it!

Way back in the early 2000's a colleague pointed out the yield curve to me. What was the yield curve? The difference in yield between 2's and 10yr US Treasury debt. We discussed at length what it meant and how we might be able to use it.

The Curve.

It is as cyclical as the market itself. Almost rhythmical. It has a habit of defining cycles.

In essence it's primary use is for lending institutions to build balance sheets easily. Borrow short term money cheaply to lend it for a longer period, capturing the spread between the two yields. Simple enough. Remember the Fed are involved when it comes to a steepening or flattening curve.

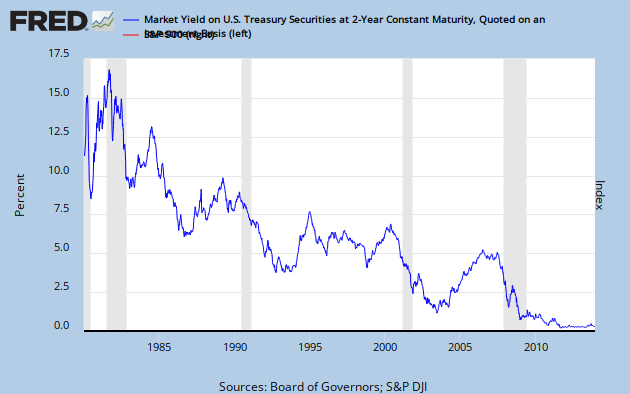

Here is the longer term chart of yield curve vs SPX.

Here is the longer term chart of yield curve vs SPX.

Steepening Vs Flattening Curve

So, as the yield curve steepens, you can bet your bottom dollar that financial institutions are making money. Conversely when the yield curve flattens it's likely that financial institutions are sacrificing some yield for more volume as the economy grows.

The cool part

When the yield curve finally moves from an inverted state and steepens for good, you can count the days to a stock market correction.

I'll show you......

There are times that the yield curve has been INVERTED. This happens when 10yr yield is lower than 2yr yield, giving a negative carry (not being able to borrow short term at advantageous rates to lend longer term).

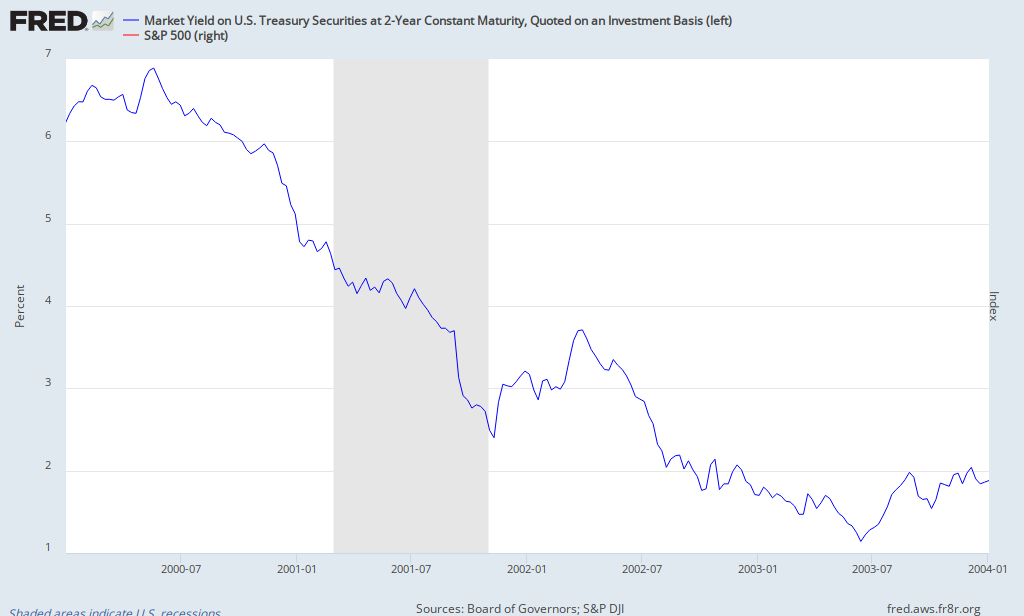

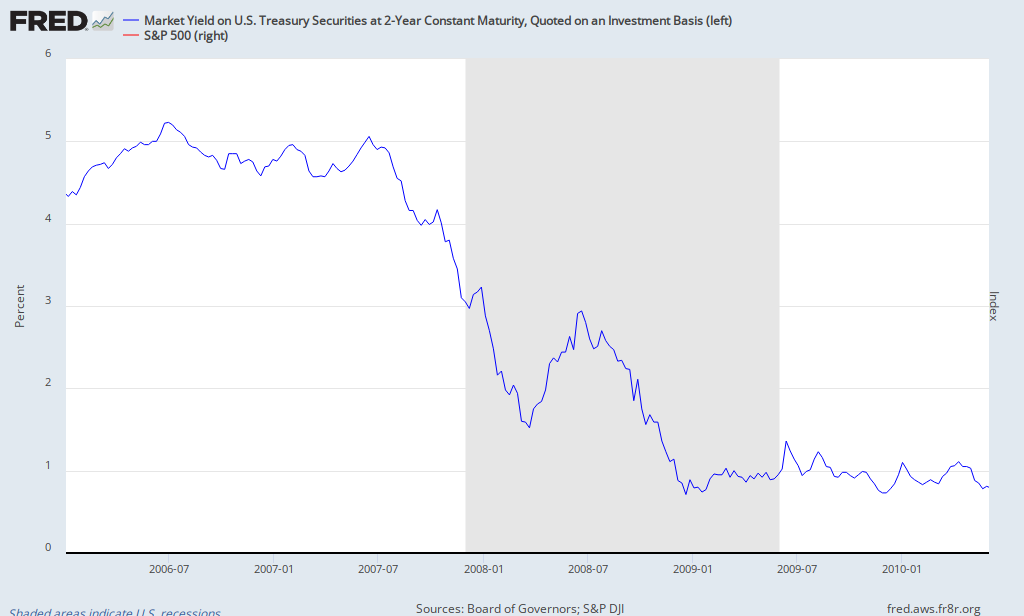

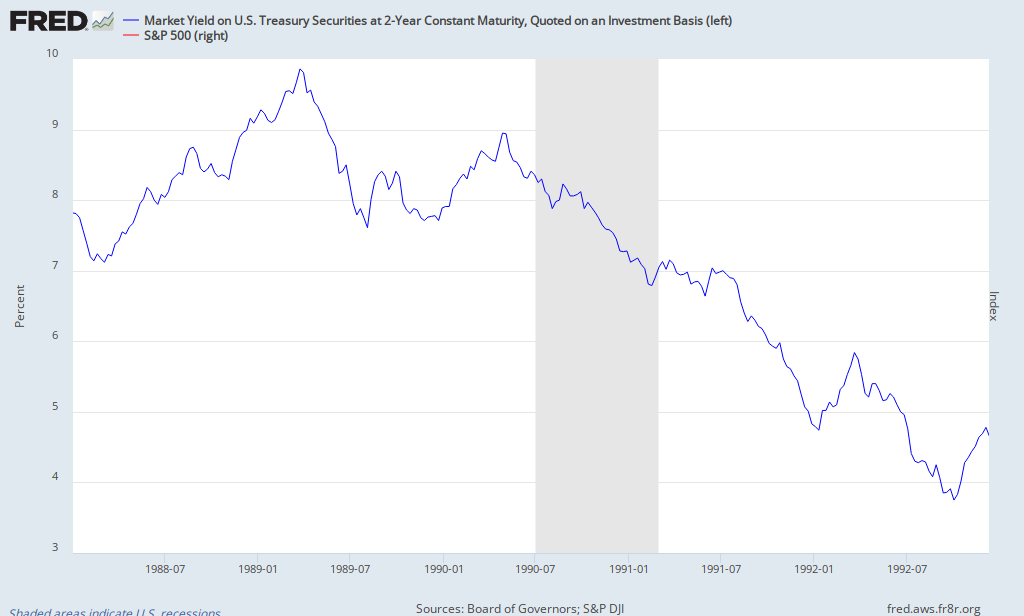

There are many and varied explanations as to why this happens, the most important thing to note is you are at the end of a bull market and are about to witness a bear market. The length of that Bear market changes according to circumstance. It's a strange sensation. You can see the yield curve steepen for good in 1990 that coincided with a correction in stocks, and in 2000 and, you guessed it, 2007!

1990

There are many and varied explanations as to why this happens, the most important thing to note is you are at the end of a bull market and are about to witness a bear market. The length of that Bear market changes according to circumstance. It's a strange sensation. You can see the yield curve steepen for good in 1990 that coincided with a correction in stocks, and in 2000 and, you guessed it, 2007!

1990

2000

2007

Implications of yield curve.

As you see flattening of the curve, there really isn't a concern as a goldilocks scenario exists in the markets. Once you enter an inverted phase, pressure starts on financial institutions to make money in other ways. They do this by increasing their risk profile for activities. At some point that inevitably comes unstuck. Call it bad financing of S&Ls, Internet incubators, Housing, Subprime!

As the yield curve is inverted, markets have a habit of rallying, the usual amount is about 6%. Use this time to build your cash positions, be at peace with your wins and your losses, do not over trade. There is an ill wind on the horizon. Timing this ill wind will be tricky, but there is one move that matters beyond any else.

WHEN THE YIELD CURVE FINALLY STEEPENS FROM AN INVERTED STATE, YOU CAN COUNT THE DAYS TO A CORRECTION.

Playing this on the short side can pay handsome dividends, however you will not sleep well as a bear has claws and all positions are subject to daily fluctuations that will force you out of your trades. You can also just be long cash which is a synthetic short as you expect cheaper prices.

These trends are very large and do not end without an awful lot of hardship and business's failing.

This is your time to be humble and help those that are less fortunate than you. Many will ask for some help, offer it freely and with good grace. You had the benefit of reading this, they did not.

Use the time of market uncertainty to assess its pulse. Use the steepening curve to understand that financial institutions will become healthy once more, no matter what the media says. When the market looks like it can't get any worse, likely doesn't! Lows have been marked by the starting of Wars, the inability of Governments to act or an Institution failing. The market will start discounting bad news and rally when everything points otherwise, be aware. This is a necessary healing process. You can benefit in the same way as before, allow the market to guide you on your journey.

Buy innovation, be brave. Some will not work out, keep your losses small, it is the gift of discipline.

Never be afraid to re-enter the same trade, just understand your entry price. Some of the best companies in the world have suffered some short term setbacks.

Once the curve has steepened and the stock markets rally on bad news, you will notice something phenomenal! You are on the right side of the market and the Fed are helping you! That is a powerful friendship to have.

Study the charts of leading stocks, they can guide you. No need to be too short term on your thinking, that is for others. Enjoy the peaks and troughs as the world really is a wonderful place. Keep your integrity, honour and discipline, it is yours alone.

Queen takes pawn.

No comments:

Post a Comment