I've been pondering for some time the extraordinary state we have found ourselves in. Recent history has given us many historic fluctuations in asset prices......

Conglomerates in the 80's.

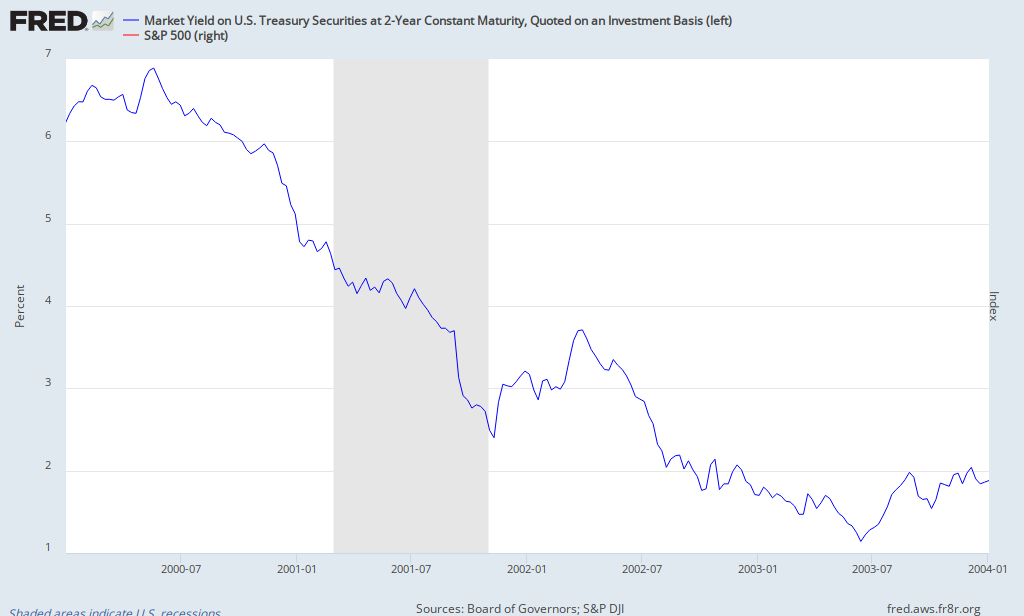

Internet stocks for Y2K.

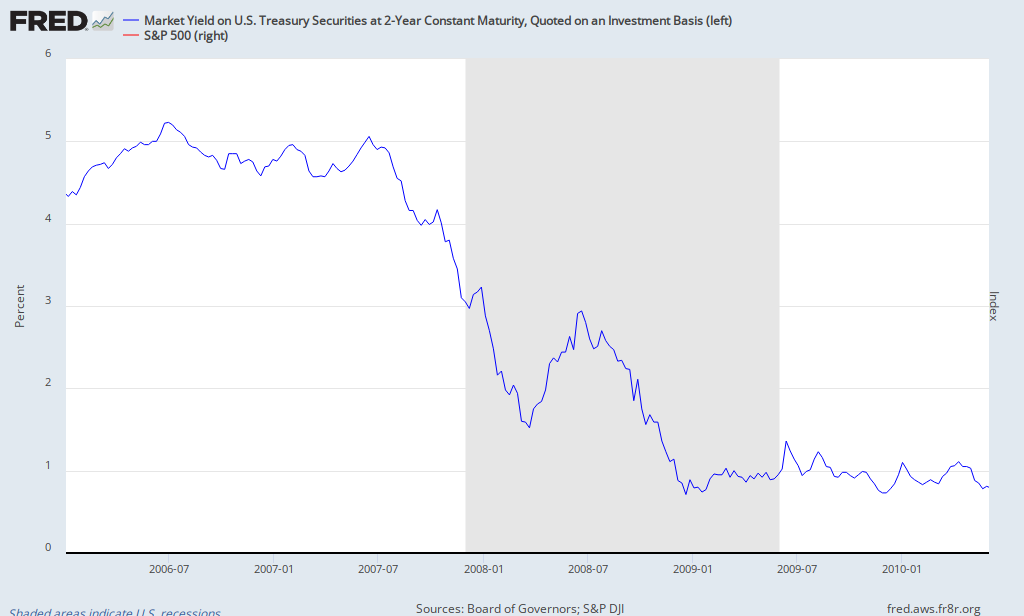

Home values in 2006-7.

Leverage funds of recent years.

Gold prices...again.

The commentary from mass media usually encompasses some ridiculous statement about why something has to happen in the future! Well, if you say it enough times, the likelihood is at some point you may stumble upon a correct answer.

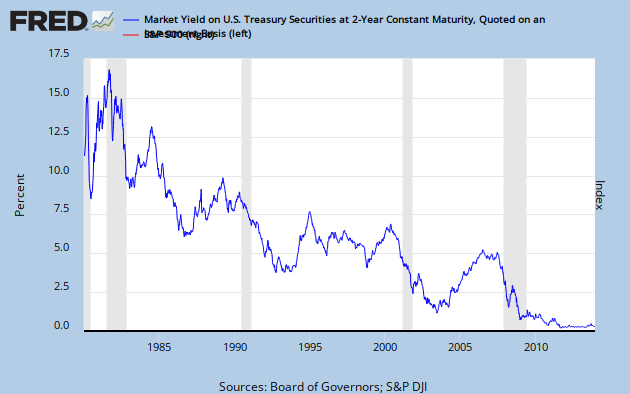

We are all aware in 2013 that bond prices likely have downside, but, not because they are a "bubble", it may well be because the USA is on its feet and fighting fit. We have seen precious metals falter since Oct 2011, just when the stock market started to correctly discount bad news for the first time in 3 years. Could the next bubble be us? Could it be that we are living and breathing and benefitting from the previous devastation, a Phoenix from the Ashes?

The US has been in an extraordinary state since 2007, Capex has been limited, cash to buy backs has been up and dividends now make the US look more like the UK than I can ever remember. I am going to assume an awful lot right now, so stick with me....

Let's just say that the we have seen "peak Washington disuption", sensible enough.

Let's also just say that the US has lost none of its entrepreneurship, think FB and TWTR for a minute.

Let's also, also say that Capex is going up, inflation will be in a tight range and the likelihood of the Fed applying the brakes are minimal.

Corporations two biggest input prices are Employment and Energy prices. Wage inflation is tepid at best, with an escalation being a little positive for inflation. Energy prices are reasonably stable, without a super-spike ala 2008, that doesn't look an issue either. Technology improvements giving productivity gains are just the icing on the cake for me.

What about M&A? Taking some well earned cash and buying some growth seems sensible enough. We have already seen some low hanging fruit being absorbed in 2012 and 2013. Which likely means that at some stage in this cycle someone will reach higher and further, paying higher prices for less of that growth. That doesn't sound at all bad for the right here, right now trade.

That's an awful lot of assumptions, I know, but.....the potential road we are traveling could well be paved with the most ridiculous upside imaginable.

Now, the road isn't without it's bumps and it certainly isn't without consequence, but those are for another time in the future. At this point we are just starting on the path towards those problems and the journey has to travel through some very dynamic and rewarding landscapes before any precipice. We may well be witnessing one of the most extraordinary times for innovation and growth that many of us have rarely witnessed. We really could be looking at a US that can propel itself once more into the forefront of the World. There are obvious risks of over-confidence, political faltering in Foreign policy and basic Washington missteps on taxation, but barring an International quarrel, I have a feeling the next "bubble" may well be an overheating US economy! The most important point to note is that overheating isn't today......

What if we are witnessing a renaissance of historic proportions that give rise to quite wonderous advances (I'm not talking stock prices here either)? Smart, sensible, forward looking individuals that aren't at the whims of very large corporations, that have little of their foresight. For those at the peak of their chosen industries right now, congratulations, but if you do not see potential changes from those around you and act on the potential, your days are likely numbered.

What does it all mean?

Quite frankly, this would point to additional advances in property prices, innovative technology, small and micro-cap still, quality food and premium services. The masses could well be pleased as this tide raises all boats.....

Queen takes Pawn