Kids, sometimes it pays to enjoy time.....

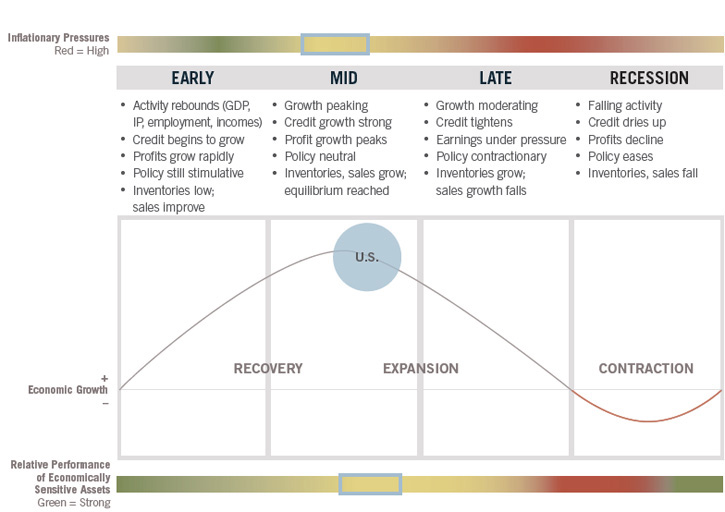

Previous posts have already noted what 2014 could look like for stock markets.

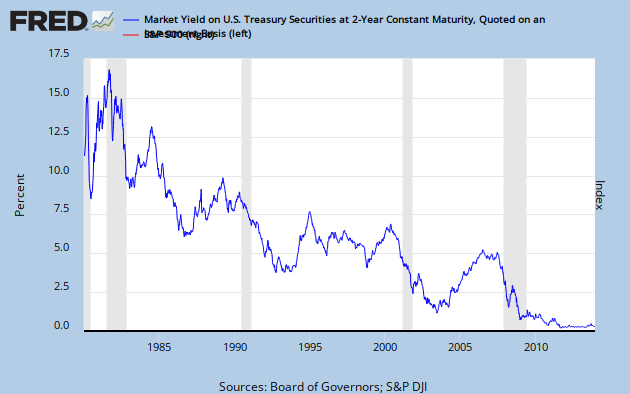

Previous posts have looked at Fed changing stance and risk free rate of return.

Previous posts have also detailed how to stay on a bull market, even though it's nearly impossible to do, I've been thrown off twice and bought back at higher levels!!

This post is more about your state of mind as the world turns.

Over the past few years, you kids have grown and Mum and I have worried endlessly about everything imaginable! Whether that worry was justified ( sometimes it was), or not is a mute point, parents do that. However, this year is different. Why?

Let me list some reasons:

1) stock markets can go up or down, but I'm pretty sure we aren't repeating 2008-2011.

2) watching, researching and trying to predict financial asteroids is time and effort consuming. The world isn't ending.

3) worrying over living isn't an excuse to not look around and enjoy life as it is being led.

4) having fun is so much more important than not!

5) I continue to see great and talented people trying new avenues for business and enjoying the unpredictability of the road they travel.

Asteroid watching and why you don't have to....

1) as long as you understand asteroids exist, you can more often than not discount them.

2) asteroids aren't actually the problem, it's the unseen bumps that cause your balance to be lost.

3) loss of balance feels like a tidal wave

4) tidal waves are not asteroids

5) sometimes there just isn't an issue. Sometimes you made the issue yourself!

Yep, that's right, if you are looking for an issue, you can see something that actually isn't there! Trying to minimize these fears is what will make time so much more productive and fun. Many people throughout history have called for complete disasters that haven't appeared and yet for every 1000 of those predictions, people remember the 1 that actually happened. Even a broken clock is right twice a day...

I've recently been enamored with "experts" arguing amongst themselves about the past. Why has this interested me? Well, that sort of points out that the risks that were so evident in previous years aren't there now or are hidden in a different place where these "experts" aren't looking, hence the arguments over history.

My telescope is watching the following:

Emerging markets, in particular currencies......not an issue

Commodity spikes, in particular......not an issue

Bond market.....2s anchored, 10s a source of liquidity......not an issue

There is every chance I'm missing something, but from what I can see, read and anticipate, it sure looks like "long fun, short asteroids" is the right stance.

As you continue to put your work in, that work actually becomes easier and less time consuming (think homework!). Now think about the effort to ski, the more effort, the easier! Simples really, but it takes a step back sometimes to smile an recognize the process. Don't underestimate the ability of chaos and the unpredictability of life. As the world turns though there are times to embrace the "here and now", this is one of those times.....

While you are it, give Mum a kiss, she deserves it.

Queen takes pawn