Kids, that's a great question and one that is often overlooked....

If there is one thing that is certain in the world, it is that cycles are inevitable. Not every cycle looks the same, not every cycle is as predictable as the last one. Human behaviour is the underlying cause for cycles, of that I have no doubt.....

The best historical evidence of cycles are the Empires. Greek, Roman, Ottoman, Persian, British to name just a few. They are littered with similar facts and waves of success and in all cases, decline. There were significantly different reasons why the Empires came about. The British Empire was one of Naval warfare and success. The Romans won on land and Sea (Europe/Meditteranean/Egypt), the Greeks on the Ocean (but locally), you get the point. Learning from these cycles is of the utmost importance to understand the potential pitfalls of the future.

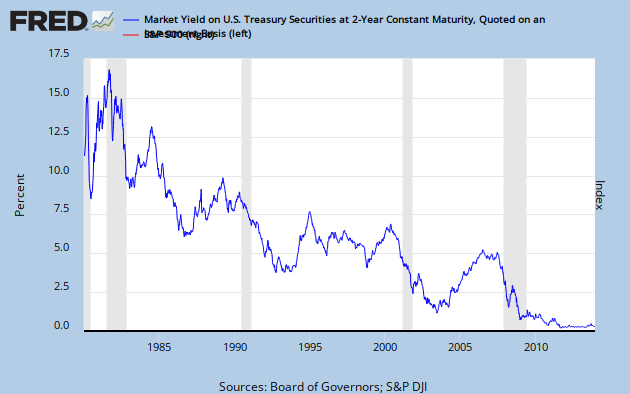

The most recent cycle for the US had the hallmarks of 1907 with a very similar financial crisis. If you want to read a quick book about it click the link. Was it predictable? If you were looking in the right place it was. I looked at the yield curve, it helped me, not others (human behaviour at its' finest). Some people looked at the source of financial leverage and could see a serious issue. The annecdote that stands out, that I couldnt understand completely, was how everyone was renovating their kitchens for gigantic sums of money, surely that couldnt be right. As it turned out, it wasn't.

Yield curve chart

If there is one thing that is certain in the world, it is that cycles are inevitable. Not every cycle looks the same, not every cycle is as predictable as the last one. Human behaviour is the underlying cause for cycles, of that I have no doubt.....

The best historical evidence of cycles are the Empires. Greek, Roman, Ottoman, Persian, British to name just a few. They are littered with similar facts and waves of success and in all cases, decline. There were significantly different reasons why the Empires came about. The British Empire was one of Naval warfare and success. The Romans won on land and Sea (Europe/Meditteranean/Egypt), the Greeks on the Ocean (but locally), you get the point. Learning from these cycles is of the utmost importance to understand the potential pitfalls of the future.

The most recent cycle for the US had the hallmarks of 1907 with a very similar financial crisis. If you want to read a quick book about it click the link. Was it predictable? If you were looking in the right place it was. I looked at the yield curve, it helped me, not others (human behaviour at its' finest). Some people looked at the source of financial leverage and could see a serious issue. The annecdote that stands out, that I couldnt understand completely, was how everyone was renovating their kitchens for gigantic sums of money, surely that couldnt be right. As it turned out, it wasn't.

Yield curve chart

The chart above is a picture perfect cycle chart, peaks and troughs.....wonderful.

Consumer Confidence

As you can see from consumer confidence, the peaks and troughs are gigantic.They are not quite as priceless as the yield curve, but it does show human nature through good and bad times. This can also be seen in Wages below.

|

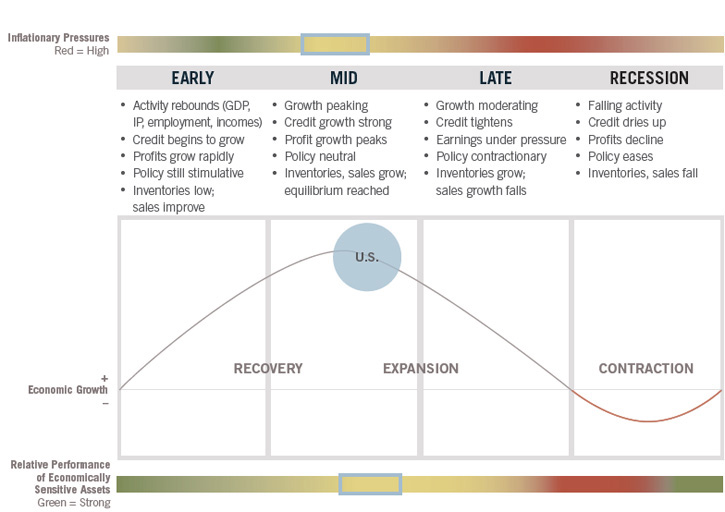

There are also cycles within cycles. This is best seen with stock markets and stock market behaviour. Below are the conditions that I like to note.....

Phase I:

Early cycle sectors include: Transports, Semis, Finance, Retail (there are others). I class this part of a bull market as PHASE I

This phase has been well discussed and documented, it is the predictive phase without solid evidence that it will happen. The rising tide has a habit of raising all boats. Consumers become more confident, spending habits start to return and populations start to finally see some benefits of better economic news in jobs. The moves are violent, sometimes eye-watering. If the market is discounting future bad news, you know you are on the right side. SPX likely outpaces Russel 2000.

Phase II:

The next phase becomes quite tricky to predict and navigate. Phase II sees spending habits return to a cyclical pattern. Spend some money at christmas, pay off the credit card in January through March. You also see some bigger ticket items being bought at the expense of other discretionary purchases. For instance, if you need a new car, you will source the money from the same pot of money, but it means you wont necessarily spend on a new garage door. Buying a house, sure, but leave some of the interior decorations for another time, including the new dining set! Again, you get the point. Wallet size starts to grow, but previous experience dictates you don't want to overstretch. At this point breakouts are the only serious playable idea. New highs are rewarding. Companies that disappoint will not reward capital. Russel 2000 likely outpaces SPX

Phase III:The real fun is Phase III. The shackles now come off. You can see behaviour change dramatically, spending habits change dramatically. New kitchens are the norm (2007). Buying Internet stocks on monday to sell on friday to finance a boat on saturday (1999). Clamouring for Conglomerates (1987) becomes the dinner party conversation. There are sizeable wins to be had from such behaviour with equivalent pitfalls to avoid at the same time. Do not be afraid to enjoy these times, they are fun, but it's time to be a little more prudent as you were successful in Phase I and II. Chaos trading as Russel 2000 will likely outpace SPX to start then turn tail as growth prospects start diminishing.

The illustration below is an excellent representation of the above from Fidelity....

The most interesting part of cycles is you dont have to be an expert to see them. If you look around and take the temperature of behaviour, there is every chance that your experiences are just as good as reading from a text-book or listening to an "expert". There are plenty of "Cycle Theories" ranging from Kondratieff, Fractals, Cyclical, Secular, 17.6year cycle, Elliot Wave, Fibonacci to name just a few. All have their merits and followers, most will work when back-tested and with hindsight! Be warned, there isn't a magic bullet and nobody has a dominant success rate.

The most wonderful time in cycles, as in life, is when you find yourself looking to the stars rather than staring at your feet. It's an uplifting feeling when you finally make that transition, as most will atest.

Queen takes Pawn

No comments:

Post a Comment